Balance Sheet

What is it?

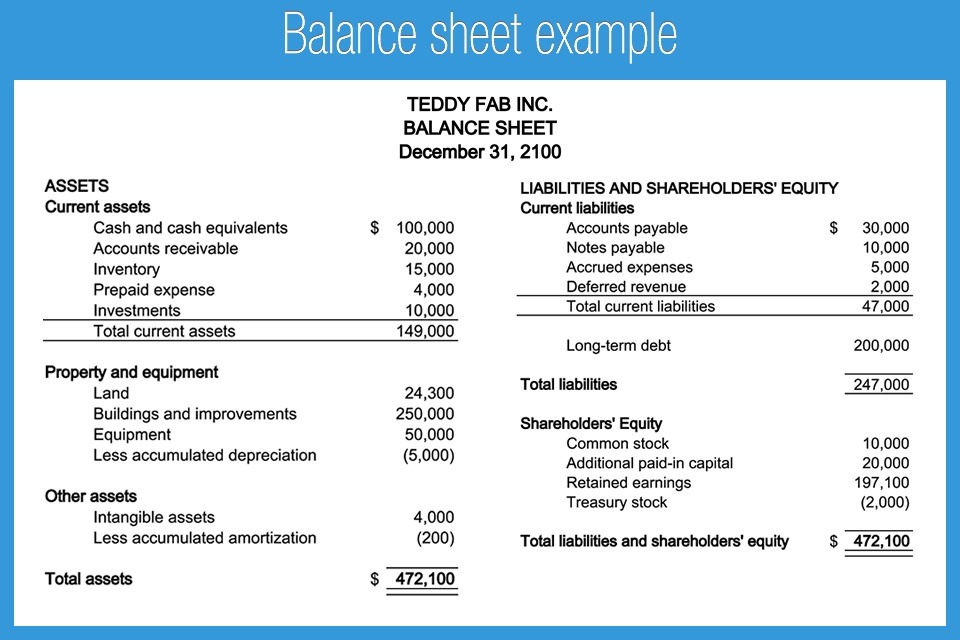

The balance sheet is a statement of what a business owns (assets) and owes (liabilities) and the net worth of the business at a specific point in time. The balance sheet is also known as a statement of financial position because it shows a summary of the business’s financial position at a particular point in time.

It provides:

- A good picture of the financial health of a business

- A tool used to evaluate a business’s liquidity.

- Help to a business owner/manager to identify trends and quickly grasp the financial strength and capabilities of their business.

- Information to current or potential investors, suppliers, some customers, government agencies, for decision making.

Balance sheet will be as important as:

- It reveals value of stockholder’s/owner’s equity which is the residual of assets minus liabilities.

- Proper notes and commentaries are brought to highlight inconsistent balances or to justify relevant and suitable ones.

What is the purpose?

A balance sheet enables you to:

- Quickly see the financial strengths and capabilities of your business;

- Review the level of assets, debt and working capital of your business;

- Compare the increase or decrease in value of your business over time;

- See the relative liquidity of your business;

- Analyze your ability to pay all short-term and long-term debts as they come due;

- Review the composition of assets and liabilities, the relative proportions of debt and equity financing and the amount of retained earnings.

We do it

Our long Experience as management accountant and finance managers enables us to have a good understanding of its purpose and to get balance sheet properly noted and commented to help decision makers and/or owner to have perfect idea of what his company worth.