Profit and loss statement

What is it?

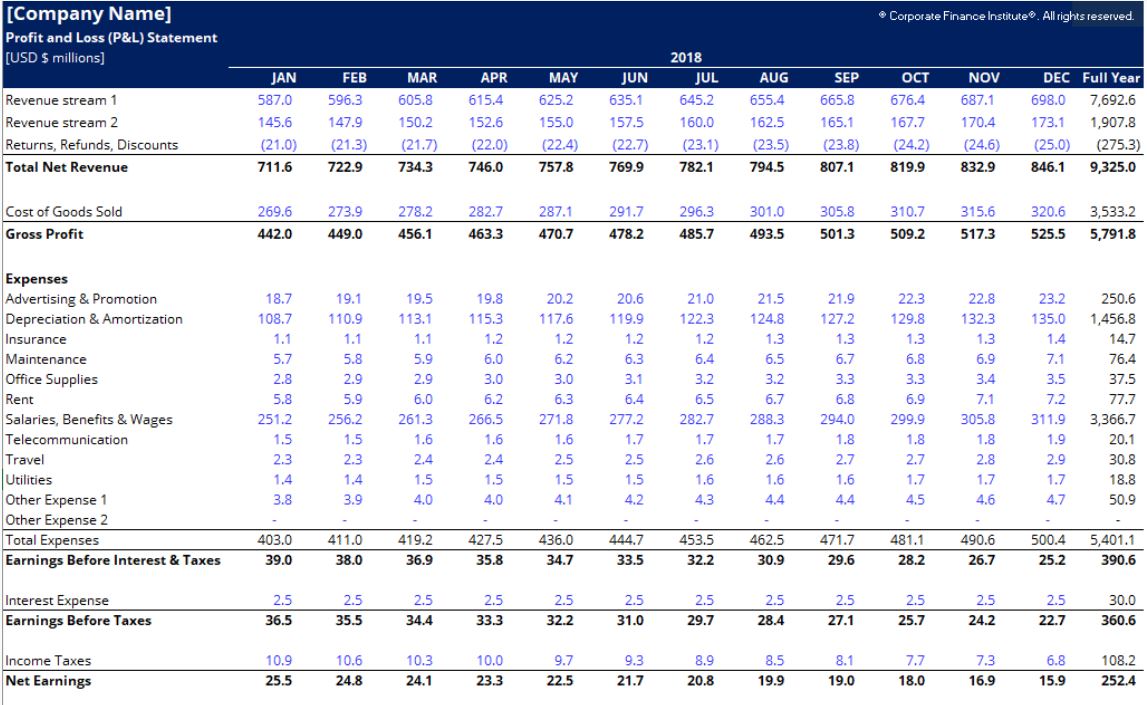

The profit and loss statement commonly called P&L is a summary report of the financial performance of a business over time (monthly, quarterly or annually)

It measures the profit or loss of a business over a specified period. A P&L statement summarizes the income for a period and subtracts the expenses incurred for the same period to calculate the profit or loss for the business.

To achieve this, accounting on accrual basis could be needed in absence of supporting documents provided income and expenses are effective. The revenues and expenses reported on the P&L statement should be:

- the revenues (sales, service fees) that were earned during the accounting period, and

- the expenses (cost of goods sold, salaries, rent, advertising, depreciation, etc.) that match the revenues being reported or have expired during the accounting period

The bottom line of P&L statement will appear as net income, which is the net amount of the revenues, expenses, gains, and losses, and taxes deductions being reported.

What is the purpose?

Producing regular P&L (at least quarterly or monthly) will enable you to:

- answer the question, “How much money am I making, if any?”

- compare your projected performance with actual performance;

- compare your performance against industry benchmarks(when it exists);

- use past performance trends to form reasonable forecasts for the future;

- show your business growth and financial health over time;

- detect any problems regarding sales, margins and expenses within a reasonable time so adjustments and correctives measures are taken

- calculate your income and expenses when completing and submitting your tax return.

We do it

From lower to upper level position our team has been in the heart of multinational companies where P&L is an utmost requirement, we are depository of such experience that we could share.