CONGO – A New Tax Treaty with China in perspective

The Senate has just adopted on August 07, 2020 in Brazzaville, the bill authorizing the ratification of the convention between Congo and China for the elimination of double taxation concerning taxes on income and the prevention of evasion of tax fraud.

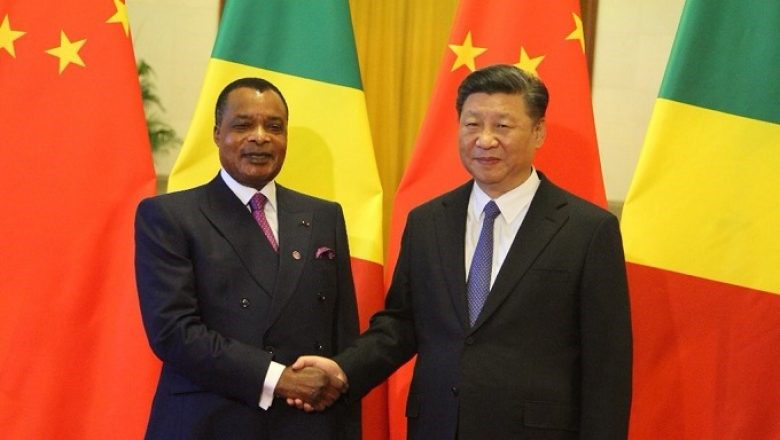

This Convention was signed on September 5, 2018 in Beijing, with the purpose of taxing income only in one of the two States where their owners reside or in respect of companies, where their headquarters are located, in order to avoid double taxation.

The targeted income categories are property income, corporate profits, profits resulting from the exploitation of international traffic, dividends, interest, royalties and capital gains.

While awaiting its ratification, It should be noted that Congo has ratified a convention of non-double taxation with: CEMAC, France, Italy, and Mauritius.